Flat River Minerals

A Mineral and Royalty Acquisition Company

Established By Professionals With Decades Of Experience In The Oil And Gas Industry

Our Companies

What We Do

Flat River Minerals (“FRM”) was established in 2019 alongside its wholly-owned subsidiary, Rocking WW Minerals, to pursue mineral and royalty interests in Wyoming’s Powder River Basin. Founded by industry experts who had previously spent their careers on the exploration and production side, FRM set out to be among a new breed of oil and gas mineral buyers focused on sustainable long-term investments driven by technical valuations.

Following its initial focus on Wyoming, FRM has since expanded its reach out east into the premier gas fields of Appalachia with Cloud Peak Minerals, its second wholly-owned subsidiary. Across all its areas of focus, FRM’s team remains committed to setting a new standard on what it means to be a mineral and royalty acquisition company.

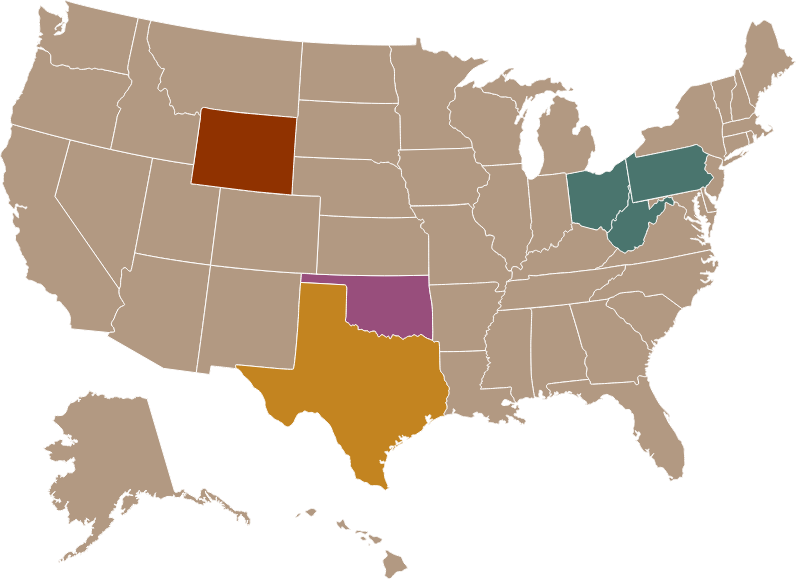

In addition to actively investing in minerals and royalties, the team at FRM manages the interests and portfolios of both Heritage Non-Op Holdings, LLC and Heritage Minerals Holdings, LLC. As previous subsidiaries of what was known formerly as American Energy Partners, the Heritage companies were formed in 2014 to pursue investments in the top shale basins in the US, including:

- The Marcellus/Utica of Appalachia

- Permian of Texas

- SCOOP/STACK of Oklahoma

All together the FRM team manages interests in over 4,000 wells across five states and basins, split between non-operated working interest and royalty wells. Currently, FRM is focused on actively investing in minerals and royalties across the country through Rocking WW Minerals and Cloud Peak Minerals. FRM is headquartered in beautiful Sheridan, Wyoming with an additional office located in Canonsburg, Pennsylvania.

Region of Operation Key

-

Rocking WW Minerals

-

Cloud Peak Minerals

-

Nova Lux Royalities

-

Heritage Non-Op

-

Heritage Minerals

Technical Driven Approach

You can trust that our mineral valuations are reliable and accurate, driven by the three factors that matter most: geology, engineering, and drill timing.

Cowboy Ethics

Flat River Minerals maintains genuine relationships at every level of the business – from landowners in rural Wyoming and Appalachia to the industry’s most notable executive teams. We’re about doing what’s right, not what’s easy.

Get the most out of your interests

Flat River Minerals was founded by career oil and gas professionals specializing in operations and acquisitions. Our team of experts has decades of experience in exploration and production that enable it to accurately value minerals based on the three things that matter most: geology, engineering, and drill timing. We pride ourselves on our ethics and honesty – we’re not speculators, brokers, or flippers. You work directly with us when you sell your minerals, which ensures every dollar goes into your pocket. Learn more about our projects in West Virginia, Ohio, Pennsylvania, and Wyoming.