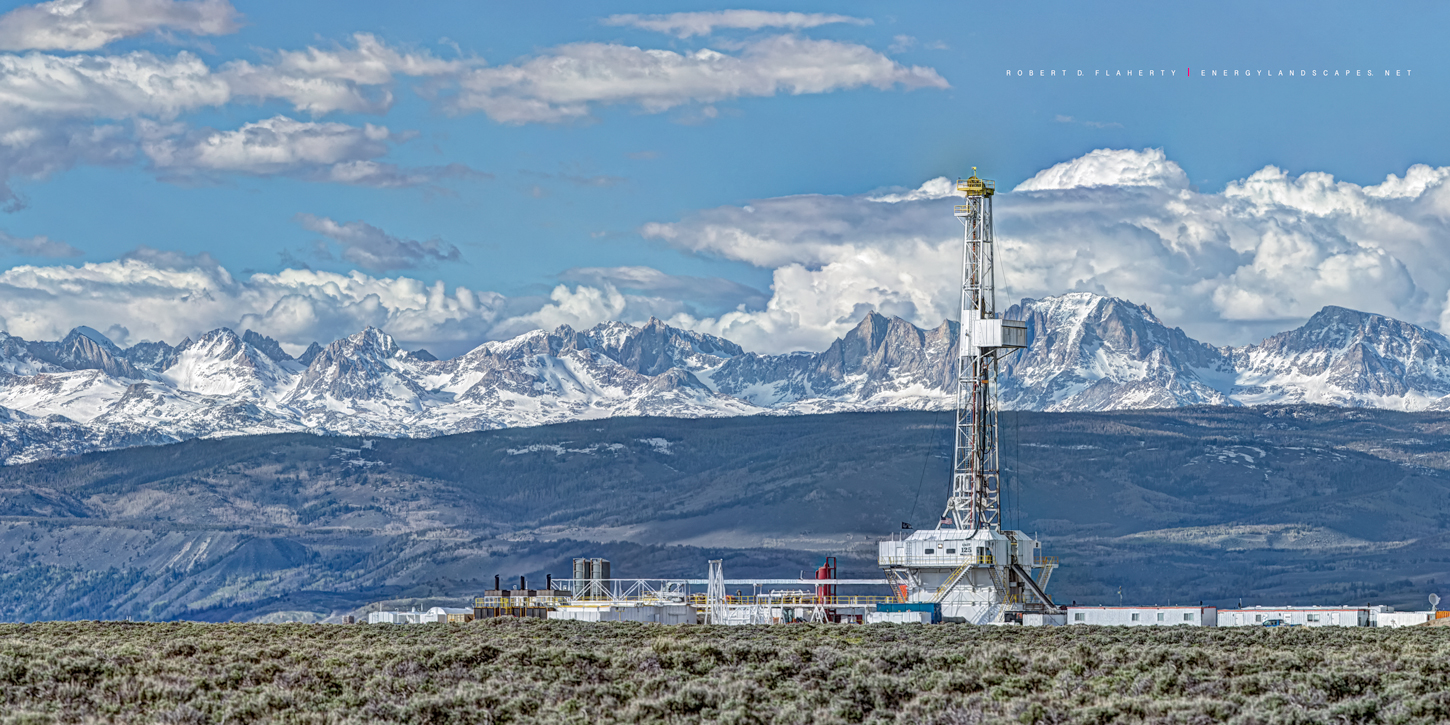

Rocking WW Minerals, LLC (“RWW”) specializes in mineral and royalty acquisitions across the oil and gas-producing regions of Wyoming. When we refer to “minerals” we mean the subsurface interests that produce oil, gas, and other hydrocarbons.

Having ownership of minerals enables an owner to grant a company a lease for the right to explore for and develop the hydrocarbons underneath the surface; “royalties” represent the portion of the proceeds owed to an individual upon the successful development of the minerals. Most often, the royalties are directly tied to the minerals but may get severed off and conveyed or sold separately.

RWW was founded by a team of experts that have spent their careers on the exploration and production side, bringing a wealth of knowledge and technical expertise to mineral and royalty acquisitions. We’re the end mineral rights buyer, which means you’ll cut out the middleman and get the most out of your interests in working directly with us. We founded RWW in Wyoming with one central premise: cut out the middleman, the brokers, the speculators, and the flippers – and ensure the grassroots mineral owners are getting top dollar.

There are often many factors (and people) to consider when you are electing to sell your minerals, rarely is it an easy decision. We’re here as a local, honest, and transparent resource for those that wish to liquidate (or partially liquidate) their mineral and royalty assets into a market few know how to navigate.

We’ve found some of the most common factors sellers consider are their family, financial goals, and risk tolerance. If history has shown us anything, it’s that oil and gas is a cyclical industry that we’ve never been able to predict accurately. If your net worth is primarily tied to your minerals, you may consider selling all or a portion of your interests in order to diversify into more predictable, lower-risk investments.

If you’re looking for cash, selling your mineral and/or royalty interests is a fast way to get the money you need to achieve your goals. Another opportunity we encourage potential sellers to explore is their ability to do a “1031 exchange,” which is the IRS provision that allows a seller to reinvest their proceeds from a mineral/royalty sale into another real estate investment without having to pay capital gains taxes.

Check out our Mineral Rights Tax Guide for more tax tips.

All in all, we’re about doing what’s right, not what’s easy. We live by the Code of the West, including Code No. 9: “Remember that some things aren’t for sale.” Our local team believes in building relationships and understanding your goals and will never pressure you into making a decision you don’t feel good about.

Many companies use the “cash-flow multiple” method of valuation (i.e. multiply your average monthly income by 36 months). This method is straightforward and easy to understand, but it does not capture the value of future income from your property.

RWW guarantees fair offers based on sound geologic and engineering analysis. The team at Flat River Minerals are technical experts in the Rockies Region, incorporating both income from existing wells AND income from future wells in its mineral and royalty valuations.

If you need funds but don’t want to sell your mineral rights, another alternative is to carve off a non-participating royalty interest (“NPRI”). This allows you to keep all the minerals, rights to bonuses, executive rights to lease the minerals, and the full remaining royalty net of the NPRI.

For example, if you’re currently leased at 18.75%, you can carve off a 3.00% NPRI, which would just reduce your royalty to 15.75%. We can help you decide what NPRI percentage to carve off based on your cash needs.

RWW is one of the few mineral and royalty acquisition companies based in Wyoming. We’re headquartered in Sheridan, so we’re intimately familiar with the land, minerals, and most importantly, the people that comprise the Cowboy State. When you sell to us, your minerals stay in the west with a local company that pays state taxes and employs Wyoming residents. You can’t say the same about the mineral rights acquisition companies located in Colorado, Texas, Oklahoma, or New York City!