If you own or recently inherited mineral rights in Tyler County, West Virginia, you’re holding a valuable asset in one of Appalachia’s most active natural gas regions. Cloud Peak Minerals specializes in purchasing mineral and royalty interests throughout West Virginia, offering fair valuations backed by technical expertise.

When you inherit mineral rights in West Virginia, the transfer typically occurs through probate proceedings. The exact process will vary based on whether the deceased left a will (testate) or passed without a will (intestate). Once the will is probated, or the court distributes the estate pursuant to the laws of intestate succession, the proceedings are filed for record in the county and vest the interests in your name.

The value of mineral rights depends on several critical factors:

Many mineral owners have questions on the value of their resources, whether it’s better to lease or sell, and how taxes work when selling mineral rights. Understanding these factors helps you make informed decisions about your family’s financial future. Cloud Peak Minerals can provide the information you need to do so.

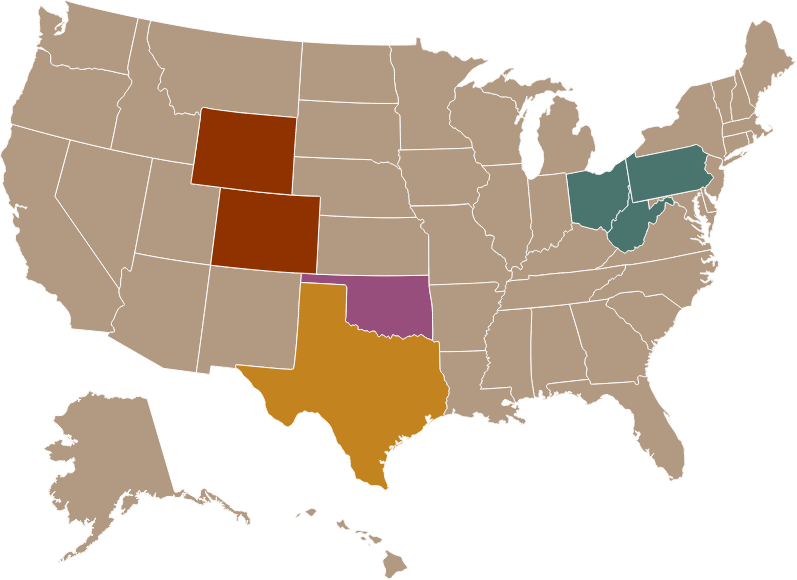

Flat River Minerals founded Cloud Peak Minerals to bring our technical expertise to the East. Our team is committed to investing in minerals and royalties across premier gas basins in the following states:

Understanding the tax implications of selling your mineral rights helps you plan effectively and maximize your net proceeds. The IRS generally treats mineral rights sales as capital gains rather than ordinary income, which typically results in more favorable tax treatment.

Your capital gains tax depends on how long you’ve owned the mineral rights and your income bracket. If you’ve held the rights for more than one year, you qualify for long-term capital gains rates, which range from 0% to 20% depending on your total income. West Virginia also imposes state income tax on capital gains, though rates vary based on your overall earnings.

The tax calculation requires determining your cost basis — what you originally paid for the mineral rights or what they were worth when you inherited them. It’s wise to work with tax professionals familiar with mineral transactions to complete this process and ensure all reporting is handled correctly.

Cloud Peak Minerals brings technical expertise and transparent valuations to every transaction. Our geologists and petroleum engineers analyze your specific acreage using proprietary data and third-party studies, ensuring your offer reflects the true potential of your minerals.

As a subsidiary of Flat River Minerals, we practice a buy-and-hold approach, meaning your minerals stay with a company committed to long-term stewardship. Our in-house title and closing teams work efficiently to complete transactions in a smooth, timely manner, putting cash in your hands quickly while handling all the complex paperwork.