Home to Morgantown and West Virginia University, Monongalia County represents one of the state’s most economically vibrant regions — and that vitality extends beneath the surface. The county’s position within the Marcellus shale formation has made it a focal point for natural gas development, creating substantial value for mineral rights owners. Whether you’re exploring options to sell your mineral rights or simply seeking to understand what you own, we’re here to help.

Many leases include postproduction cost deductions, allowing operators to subtract expenses for gathering, compressing, and transporting gas before calculating the royalty. These deductions can significantly reduce your net payment.

When evaluating inherited mineral rights in Monongalia County, understanding existing lease terms helps you assess whether selling makes more financial sense than continuing to receive royalty payments. Royalty payments provide ongoing income but come with potential production declines, price volatility, higher ordinary income tax rates, and ongoing management responsibilities.

The value question dominates every mineral owner’s thinking. Several factors combine to determine what your Monongalia County mineral interests may command in today’s market, including:

Nonproducing mineral rights typically sell based on lease bonus comparables and development potential in your specific area. Producing mineral rights command significantly higher prices, often calculated as a multiple of annual royalty income. Professional mineral rights buyers in Monongalia County leverage sophisticated production forecasting software to generate accurate valuations that account for these complex variables.

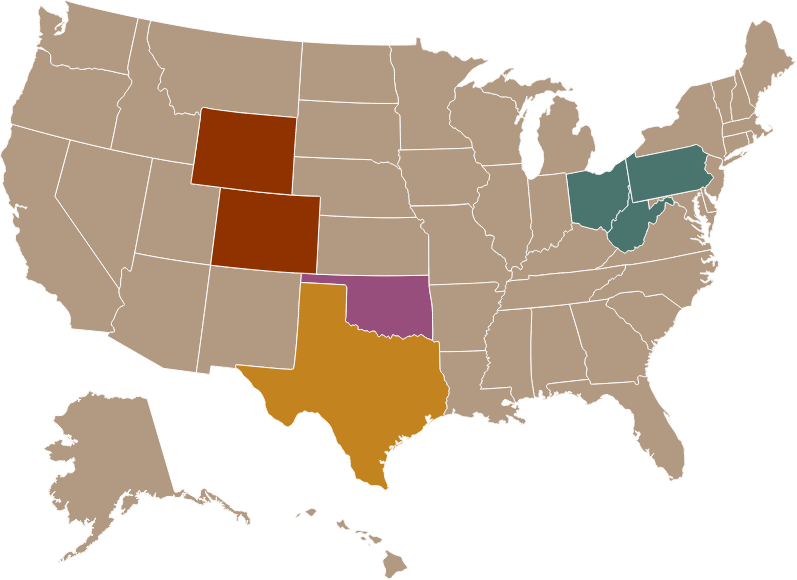

Flat River Minerals founded Cloud Peak Minerals to bring our technical expertise to the East. Our team is committed to investing in minerals and royalties across premier gas basins.

Royalties represent the payment mineral owners receive when operators extract and sell natural gas from their property. Understanding how royalties work helps you evaluate whether to lease, sell or hold your mineral interests.

When you lease your mineral rights to an operator, the lease specifies a royalty percentage. Your actual royalty payment depends on the following:

Cloud Peak Minerals brings specialized Appalachian expertise to every transaction. As a subsidiary of Flat River Minerals, we combine technical knowledge from career oil and gas professionals with ethical business practices rooted in transparency and integrity.

Our team uses advanced geological analysis and production forecasting to conduct comprehensive mineral rights valuation for Monongalia County owners. We’ll explain exactly how we calculated your offer and what factors influenced the valuation. Our in-house title and closing teams handle all paperwork to complete transactions.