With increasing competition between companies that buy mineral rights, the owners of those rights have more options than ever. Selling oil and gas royalties with the support of an experienced team results in greater financial flexibility, predictability and administrative simplicity.

Our leadership and acquisition teams have extensive experience working in both the domestic and international oil and gas sectors, and we use what we’ve learned to make sure mineral rights owners get the best possible prices.

Savvy mineral owners know timing is everything — and in today’s market, there’s a strong case for turning mineral rights into liquidity. If you’re researching why sell mineral rights, here are the biggest factors driving seller demand right now:

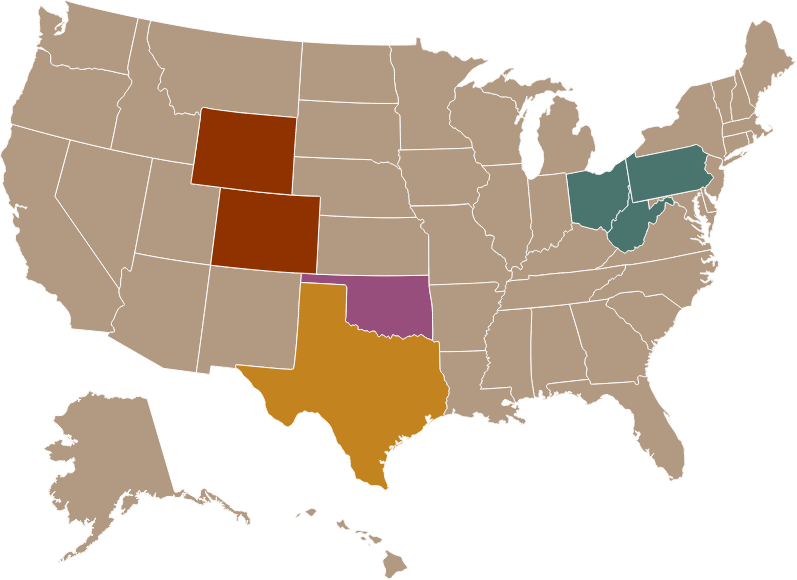

Flat River Minerals founded Cloud Peak Minerals to bring our technical expertise to the East. Our team is committed to investing in minerals and royalties across premier gas basins in the following states:

In Pennsylvania, we purchase minerals such as coal, gas and oil in the following counties:

We purchase oil and gas rights in these Ohio counties:

At Flat River Minerals, selling your minerals is simple, transparent, and efficient:

We hold ourselves to cowboy ethics — honesty, authenticity, and doing the right thing even when it’s not the easy thing. Sellers choose us because we keep our word and make the process as seamless as it should be.

Selling mineral rights can be a once-in-a-lifetime transaction, and a few missteps can cost you serious value. Here are the most common pitfalls to avoid:

Some buyers pose as end purchasers but are really brokers or “flippers” who quickly resell your minerals for a higher price. They profit from the spread — not from owning your minerals — which means you likely left money on the table.

At Flat River Minerals, we are the end buyer. We follow the old code of cowboy ethics, meaning we value genuine relationships at every level of our business. We perform our own technical and economic evaluations and purchase directly, ensuring transparent pricing and fair value. Many companies that buy mineral rights evaluate and purchase directly, so you can avoid unnecessary markups by confirming whether you’re dealing with the end buyer.

Attorneys or brokers may offer to “market” your minerals on your behalf, often locking you into exclusive contracts that give them control over who you can sell to — and how much they take from your proceeds. These agreements can limit competition and create conflicts of interest. Before signing anything, be sure you understand the terms and maintain the freedom to evaluate multiple offers yourself.

A ROFR in your lease gives your current lessee the option to match any offer you receive — which sounds harmless, but it can freeze your sale for months, discourage other buyers, and reduce competitive bids. Keeping your minerals free of a ROFR ensures a faster, cleaner sale process.

Bottom line: The best protection is doing your homework — research potential buyers, read the fine print, and make sure you’re talking directly to the party putting up the capital.